Emergency Preparedness and COVID-19: Financial Stress Test

In the past few weeks, many of us went through a lot of effort to ensure we had emergency supplies for the anticipated quarantine. How many of us put in the same effort to make sure we are financially prepared? The recent market events highlight the importance of having an appropriate asset allocation plan to ensure that we have cash when we need it most and that we have peace of mind in a time of crisis. This is important for those that are retired but also for those that are working and are in the accumulation phase of investing.

Broadly speaking, asset allocation is the amount of a portfolio that is allocated to stocks, bonds and cash. There is “no one size fits all” for an appropriate asset allocation, but there are common factors that should be considered in all asset allocation plans. A successful asset allocation plan is one that will help you achieve your goals and allows you to embrace the discipline of sticking to the plan even when the stock market goes down significantly.

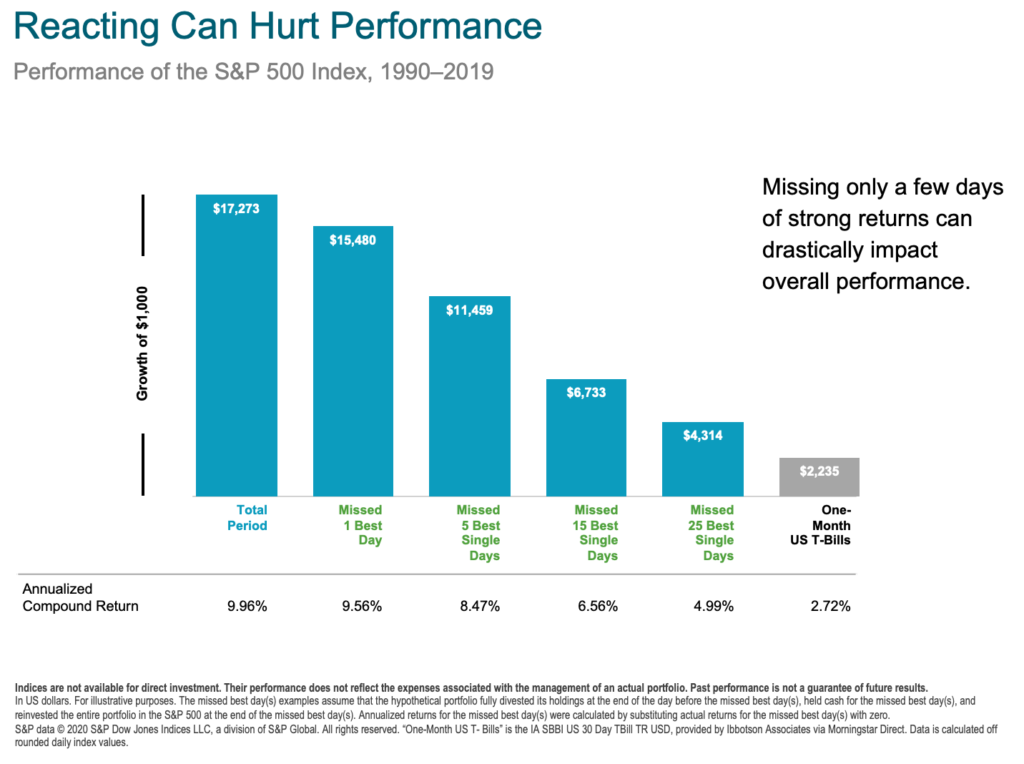

The risk of not having the appropriate asset allocation is that you may sell in a panic, locking in a loss. You then risk missing strong market returns that often come at unpredictable times. Recently the U.S. stock market went from all times highs in February to bear territory at a remarkable speed. It then moved up rapidly with the month of April being the best for the S&P 500 since January 1987, returning 12.7%. The below graph highlights how missing just a few days over a 19-year period can greatly impact your returns.

For those who were not financially prepared in advance of the recent market volatility, now is the time to reexamine your investment strategy and determine how it served you.

Did you feel you had enough cash for your expenses?

Did you sell in a panic and miss the returns since April?

Did you feel prepared?

The recent market provided a stress test for your portfolio but also for you the investor. Behavioral economics studies often state that the investor feels the pain of a loss twice as much as the joy of a gain. This is a good time to observe how you felt, and what actions you took or did not take. Your actions and feelings will guide you in crafting a plan for your investments moving forward. Working with a financial advisor can help you to determine what your allocation should be to help you to achieve your goals, but also sleep at night.

This all speaks to advance planning and organization for your finances, just as many did with their supplies. Those that loaded up on supplies were focused on the pain of running out. The same careful planning should be applied to your investments. We don’t know exactly when market downturns will happen, but we know they will occur. It is easy to feel the pain of the downturn in the market and want to sell. If you have the appropriate plan in place in advance, you will be able to stay the course and ride out the storm.

Notes: The above article is the author’s sole opinion for information and discussion purposes only. No part of this article is intended to constitute investment, legal or tax advice. The opinions expressed herein are not suitable for all persons. Consult your investment, legal and tax professionals for advice relating to your personal situation. No offer or solicitation is made by this article. Past performance is not indicative of future results.