Talking about TIPS

Is inflation dead? Or about to be born again? It’s a topic in the news and is something to think about.

The Coronavirus economy, and the market’s resulting gyrations, suddenly have many people talking about inflation. Inflation hobbled the 1970s economy, and taming it was a signature victory of President Reagan in the 1980s and of Paul Volcker, his 6 foot-7 inch cigar-chomping Federal Reserve Chairman. Volcker doggedly raised interest rates to 20%, causing a recession, to wring out inflation. The economy then surged, Monetarist economics ruled the day, and Volcker became a Wall Street hero as well as a household name.

In the decades since the 80s, however, experts’ inflation warnings have repeatedly proven wrong. After the 2008 Financial Crisis, surging fiscal deficits based on an unprecedented $800 billion economic rescue package, along with rising national debt and the Fed’s super-easy monetary policy including “lower for longer” and ZIRP (zero interest rate policy) produced a decade of inflation under 2%. Experts can’t fully explain it. In the post-crisis years, the Fed has struggled to actually raise inflation up to 2%, which was deemed the optimal level for healthy growth. So far it has been unsuccessful.

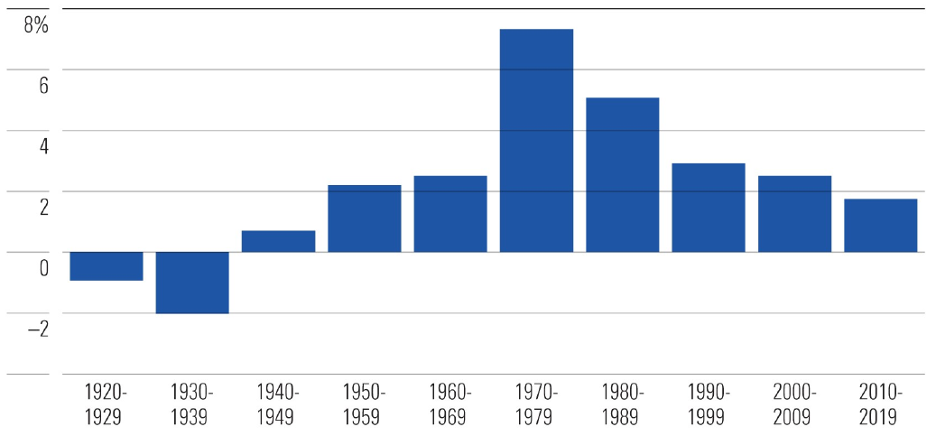

Average Annual Inflation Rate by Decade

Now in 2020, the Coronavirus economy has upended our lives, the markets, and also the economy. Pandemic precautions have kept workers at home, disrupted supply chains, restricted industrial production, and postponed capital expenditures and personal consumption. Household appliances, building supplies, home furnishings, and even automobiles are in short supply as doing everything-at-home has pushed demand for home-based products up. Although social restrictions have caused job losses for many workers, those consumers lucky enough to be working, mostly from home, have deferred all kinds of spending, from restaurants and retail to air travel and vacations. They’ve refinanced their mortgages and have cash to spend, creating pent-up demand as if it were wartime. Government spending is through the roof with the gut-busting $2.2 trillion CARES Act, and Congress is working on an encore. Monetary policy has become easier than ever, with the Fed printing money to buy corporate bonds and make loans to targeted industries. The Fed even revised its official inflation guidelines to allow temporary exceptions above its 2% inflation ceiling, so it can stimulate even harder.

In the Coronavirus economy, consumption is delayed, production is constrained, cash is accumulating, stock market wealth is surging, and government fiscal and monetary stimulus – well, they’re off the charts. So there’s a good argument that inflation may really come back, this time. This is why inflation is in the news, and why people are talking about TIPS: Treasury Inflation Protected Securities.

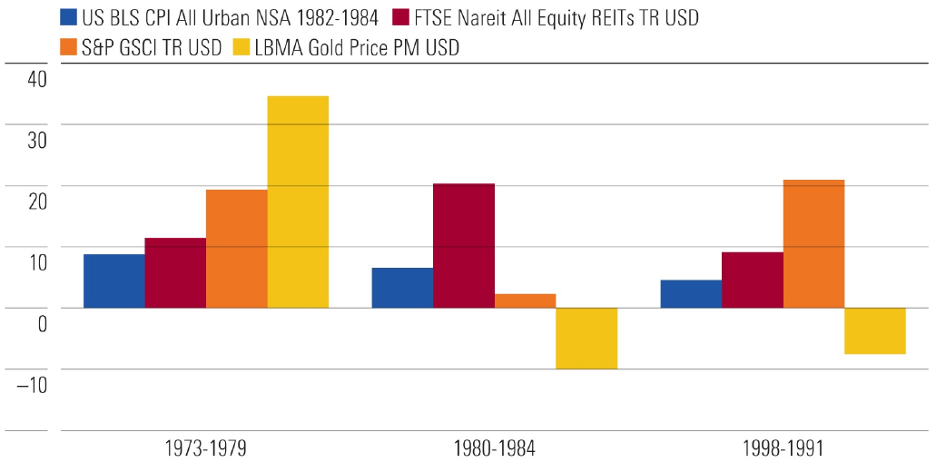

Inflation-related assets traditionally included things like commodities, real estate, gold, short term bonds, and even stocks. These asset classes have some inflation-resistant fundamentals, along with a lot of other economic, liquidity, market, and volatility baggage that have given them an unreliable relationship to inflation. Compared with the CPI (blue in the below chart), it’s evident that Real Estate Investment Trusts (in red), commodities (orange), and gold (yellow) haven’t tracked inflation particularly well during the inflationary periods when it matters most.

Total Returns for Commodities, REITs, and Gold During Selected Inflationary Periods

But now we have TIPS, the one security that is actually designed to pay you for inflation. Just what are TIPS and how do they work?

A Unique Investment Animal

TIPS are U.S. Treasury bonds and come backed by the U.S. government’s full faith and credit, so they are considered credit-risk free. The twist with TIPS is that their principal value gets adjusted each year based on the Consumer Price Index (CPI), preserving your purchasing power against inflation. In the case of deflation, the principal value will fluctuate downward during its life, but if you hold the bond until maturity you receive the greater of the adjusted principal or the original principal. So if you hold them to maturity, the face value is protected against both inflation and deflation. With a two-pronged Treasury guarantee of both repayment and inflation protection, they seem tailor-made for investors seeking safety.

What about the coupons? As with a vanilla Treasury bond, TIPS’ coupon rate is fixed at issuance. Because the inflation adjustment is made to the principal, the coupon represents only the “real” rate of interest, and is thus lower than on vanilla (“nominal”) Treasuries. TIPS’ semiannual coupon payments are based on the adjusted face value, so they go up with inflation, too. Coupon payments will, however, decline if there is deflation. Coupons don’t benefit from a “greater of” adjustment; they simply track inflation, both up and down, as you’d expect.

What Yield Is Real?

How should you understand these principal and coupon adjustments? TIPS are an innovation for investors (and for economists) because they clearly distinguish the real return from the inflation return. Their inflation compensation is paid separately, through the principal adjustment, so a TIPS yield represents pure real yield, something that wasn’t observable before.

What does real mean? With traditional bonds, the yield you are promised is denominated in future dollars, whatever they may (or may not) be worth. That “nominal” yield is comprised of an expected inflation rate (to keep up with the expected shrinking dollar) plus a real yield. Real yield is the economic return on your investment. It’s your increase in wealth in tomorrow’s dollars, and it’s the return you ultimately care about. If an investment’s return after inflation is zero, then you didn’t really earn anything and aren’t really richer.

The inflation return is observable through the expected or “breakeven” inflation rate: it’s the difference between a Treasury bond’s yield and that of a similar maturity TIPS. If a nominal Treasury is yielding 3.5% and a comparable TIPS is yielding 1.5%, the breakeven inflation rate is 2.0%. It’s what the market is predicting and pricing in. TIPS investors (if they hold to maturity) are formulaically protected against inflation, no matter what it turns out to be.

TIPS in the Market

TIPS have been issued since 1997 and can be purchased for as little as $1000. But while U.S. Treasury markets are probably the deepest and most liquid in the world, TIPS represent only about 9% of Treasuries outstanding. The TIPS market’s smaller size, fewer participants, and the bonds’ unique features make for less liquidity and more volatility, especially during periods of market stress. On the plus side, TIPS have very low correlation to other asset prices and may be a good way to stabilize your portfolio.

How do TIPS perform? TIPS will outperform nominal Treasuries when actual inflation exceeds the inflation that was assumed in the nominals’ yield (the breakeven rate). Unfortunately, the inverse is also true: when inflation comes in lower than expected, they underperform nominals. With nominals you are making a bet (taking a risk) that inflation won’t be worse than is priced into the bond. With TIPS, you’re not betting, you’re getting insurance: you may do better or worse than nominals, but you can never be hurt by inflation as long as you hold to maturity.

What about everyday liquidity and market pricing? How will your TIPS be valued during their life, or if you sell them before maturity? Market prices have some obvious drivers, but are ultimately unpredictable. TIPS prices fluctuate based on changes in real interest rates, as you’d expect. Less intuitively, changing inflation expectations affect investor demand, and hence TIPS prices, even more than does actual inflation. If you sell your TIPS early, you get the market price based on supply and demand. You lose that formulaic inflation-tracking precision. To be assured of TIPS’ inflation protection, you must buy them at a positive yield and you must hold them until maturity.

What to watch out for? Although TIPS do pay you for inflation if you hold to maturity, you can still lose money on a real, after-inflation basis if the real yield to maturity is negative. Like it is in today’s market. The 10 year nominal Treasury bond yields about 0.80%; net of expected inflation of about 1.7%, that leaves a clearly negative real yield. Similarly, the 10 year TIPS yield (which is purely real return, since the inflation adjustment is made to the principal) is also negative, about -0.92%. To produce a yield that’s less than its 0.125% coupon, the bond must be trading at a premium, about $110 for every $100 in face value. The $10 reduction over the bond’s life (separate from the inflation adjustment) represents the negative real return, and can offset your inflation return. You paid $110 and received $100 in inflation adjusted dollars. You got your inflation adjustment, and inflation didn’t hurt you, but you still lost money after inflation. You earned a negative real yield.

TIPS taxation is straightforward, but there is one quirk. Like Treasuries, TIPS are subject to U.S. income tax and exempt from state and local taxes. The quirk is that they generate taxable phantom income. That unique principal revaluation for inflation is treated as taxable ordinary income (or loss) each year, even though the investor hasn’t received it. It’s unlikely to be significant unless inflation takes off, but can be a recordkeeping headache. One solution is to hold your TIPS in a tax-deferred account, like an IRA or 401(k).

TIPS are clearly not simple, but neither are current conditions. After laying low, fooling investors, and skipping an entire generation, the inflation demon became almost an afterthought. But now the signs appear aligned for a rebirth, and that bellicose Federal Reserve has loosened it inflation limits and become a permissive parent. So whether it’s simple or not, there is a lot to think about, and to discuss with your financial advisor.