Inflation Concerns

Inflation concerns are in in the headlines. The CPI rose some seven percent over the twelve months ending December 31, 2021. We believe that inflation is one of the most under-appreciated risks to a successful financial future.

The cause of the recent inflation spike is often broadly attributed to economic effects of COVID-19. The US government supported ultra-low interest rates and massive stimulus spending, even including checks issued to individuals, to help the U.S. avoid or get out of a potential COVID recession. This combined with “cabin fever” created a huge demand surge for goods that were low in supply due to numerous supply-chain problems. Many prices rose as a result, some substantially.

Does this signal broad longer lasting inflation or just a temporary reaction to the swift COVID recession?

The Federal Reserve has expressed concern regarding inflation increasing above their 2% target and have announced a few recent changes in policy. The fed changed its tune from speaking of inflation as “transitory” to something more persistent. Just last October, we were expecting one increase in Fed funds rate in 2022, but now most market experts are expecting three or possibly four rate hikes in 2022. In addition, at the last policy meeting the Fed said they were even considering quantitative tightening (shrinking their balance sheet). The Fed seems to be planning to try to slow inflation without moving the economy into a recessionary downturn. (A heady challenge.)

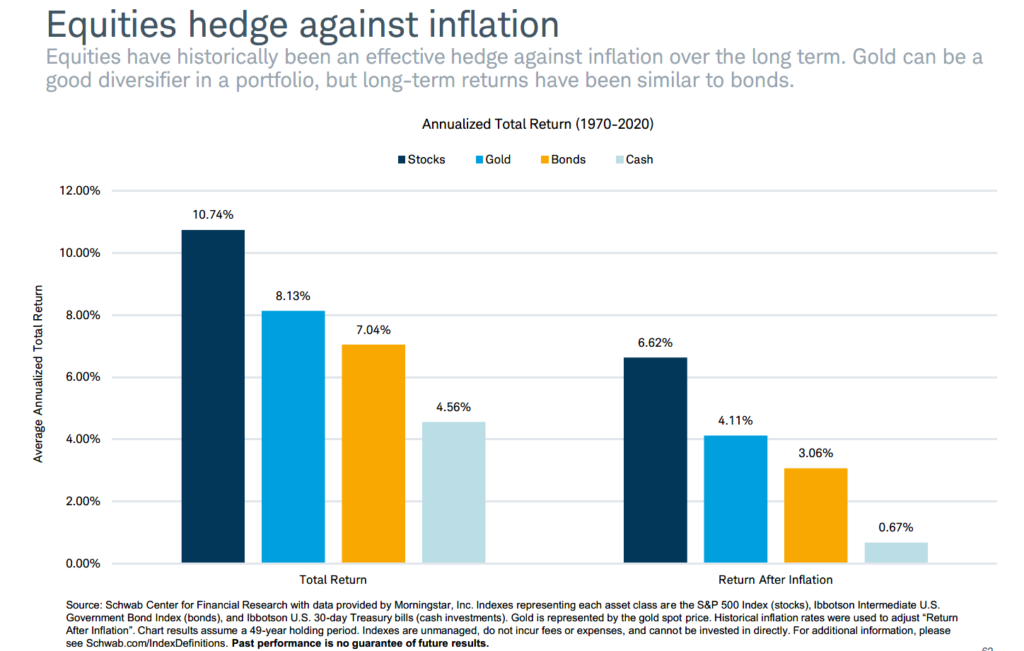

As each of us examines our concerns regarding inflation, it is important to determine what we think our concerns are. The current rise in inflation may be transitory. But what if it is not? The reason most of us save and invest is to allow us to make future purchases-whether it is for a home, college expenses, or basic retirement income needs. Inflation is a concern when you consider how long your money must last and the impact inflation could have on your future purchasing power. Remember, future inflation figures compound over a lifetime. We can attempt to reduce the effects of inflation by seeking to outpace it with our investments, utilizing an asset allocation that targets a real return higher than inflation which, in turn, may allow us to maintain, or perhaps even increase, future purchasing power. Past performance is no guarantee of future results. But we can look at history to see what happened in the past. This graph below shows annualized total returns for the period 1970-2020.

Recall the 1970’s investment doldrums – followed by wild inflation and subsequent rises in interest rates to stamp out that runaway inflation in the early 1980’s? Interest rates were 20% or more even. The stock market crash of 1987, the 1989-90 recession, the tech-wreck of 1999, the stock market crash of 2009, the COVID-19 market crash. Despite all this, in the period from 1970 through 2020 equities were an effective hedge against inflation across those several cycles; PROVIDED you had the fortitude to stay invested.

There is always uncertainty, and there are always reasons to be concerned. It is important to look for an asset allocation that is appropriate for you: to help you achieve your goals, but also within your risk tolerance profile so that you remain calm and avoid panic leading to withdrawal from the market (thus locking losses).

Financial planning can help you determine the best path for you and your family. We are here to help, contact Eastgate. Lighting a path to a secure future.

Notes: The he above article is the author’s sole opinion for information and discussion purposes only. No part of this article is intended to constitute investment, legal or tax advice. The opinions expressed herein are not suitable for all persons. Consult your investment, legal and tax professionals for advice relating to your personal situation. No offer or solicitation is made by this article. Past performance is not indicative of future results.

Felicia Davis O'Malley, MBA is a Managing Director at Eastgate Capital Advisors LLC, an Illinois registered investment advisor. Contact Felicia for more information at fomalley@eastgateca.com, 312-690-4902 or www.eastgateca.com.